Thoughts on Leverage and Compound Growth

I recently read The Snowball: Warren Buffett and the Business of Life by Alice Schroeder, a comprehensive 800+ page biography about "The Oracle of Omaha". Buffet is known as the most influential investor of our age - having amassed a personal net worth of over $100 billion through the principle of value investing.

My biggest takeaway from reading is the idea of leverage and compounding. When used together effectively, they create an engine for exponential growth.

Leverage and Compounding

Leverage is the ability to make use of something that you have.

Give me a lever long enough and a fulcrum on which to place it, and I shall move the world

Archimedes, greek mathematician

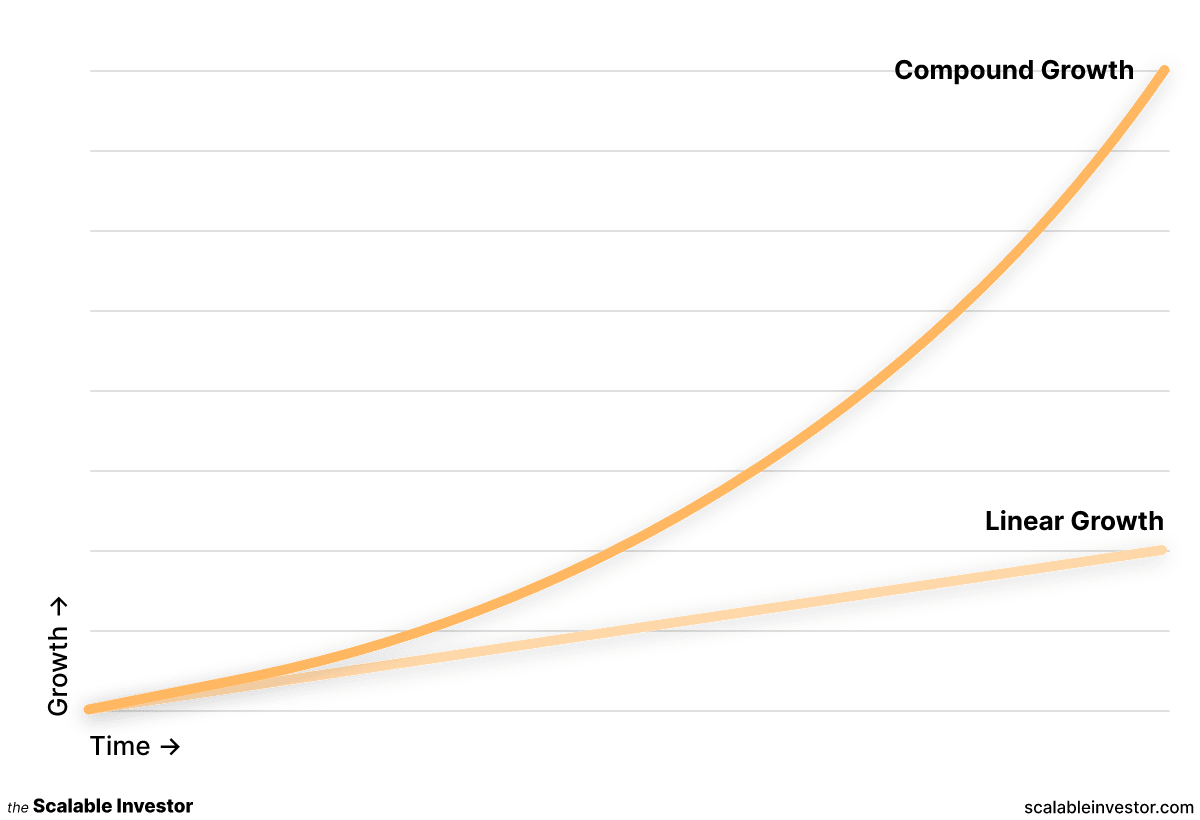

Compounding is an investment strategy that can generate exponential returns. In financial investing, this involves using your assets (e.g. money) to create a positive return, and then reinvesting the "interest" back into your investment.

Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it

Albert Einstein

Compound Growth

Money, when leveraged (wisely), can generate interest which when reinvested year after year, creates compound growth.

In terms of Warren Buffet, this is Berkshire Hathaway, a holding company that he grew from a failing textile business to one of the largest multinational conglomerates in the world.

But money isn't the only investment that can compound. Intangible “assets” like influence and reputation follow a similar trajectory. However, not all “assets” are equal, and many of them do not compound as easily (or at all) as financial assets.

Non Compounding Assets

While compounding can result in exponential growth that becomes easier over time, many things, such as physical skills, do not exhibit this property. Rather, these tend to follow an s-curve - a slow ramp up, followed by rapid growth, and finally a leveling off near the end.

By Qef (talk) - Created from scratch with gnuplot, Public Domain, https://commons.wikimedia.org/w/index.php?curid=4310325

When I was in highschool, I competed in track and field. I specializing in 800m - in my first season of running, I was able to drop my 800m time from 2:54min to 2:20min in the first year (34s). Then to 2:08min (12s) in my second year. It took the remaining years in highschool to drop down to 2:03min (5s). Even though I was putting in more effort to my training, it was harder to eke out gains in my time. At higher levels, professional athletes may spend years trying to improve their times by mere fractions of a second.

This is not to say that investing in your ability to run the 800m is bad; rather, that it does not lead to compound growth.

Compounding Assets

There are many other things outside of money that do compound. Take influence. The more influence you have, the easier it is to get more. You can leverage your influence into bigger deals or more high profile projects that result in even more exposure and influence. You see this across social networks, both online (eg. twitter, facebook, youtube) and real life (eg. celebrities, politicians, CEOs).

The Snowball

The title of Buffet's biography is aptly named - a snowball starts small but as it picks up momentum, it becomes unstoppable.

The snowball just happens if you’re in the right kind of snow[...] I don’t just mean compounding money either. It’s in terms of understanding the world and what kind of friends you accumulate. You get to select over time, and you’ve got to be the kind of person that the snow wants to attach itself to. You’ve got to be your own wet snow, in effect. You’d better be picking up snow as you go along, because you’re not going to be getting back up to the top of the hill again. That’s the way life works.

Warren Buffet

Now its important to mention that leverage and compounding growth are at the end of the day means to an end. The end that we all strive for as people is ultimately what each one of us finds meaningful.

Warren Buffet's primary snowball is making money. In that pursuit, Buffett leveraged his money to establish a legendary reputation for integrity, as well as a dizzying network of friends and partners. Each of these areas have become massive snowballs in their own right, feeding and growing off each other.

The biography of Warren Buffet serves as a call to action for the reader to think critically about their own snowballs. What are you accumulating? Is it the "right kind of snow"? And how do you leverage what you have to compound its growth?